HIRING A MOTORCYCLE ACCIDENT LAWYER IN MICHIGAN

In the state of Michigan, it is essential to consult an experienced motorcycle accident attorney immediately after experiencing a motorbike accident.

Hiring motorcycle lawyers provides you with a team of credentialed representatives that will fight to win you or your loved ones the settlement that is deserved. They’ll make sure your questions are answered, your motorcycle injuries are evaluated thoroughly, your case is filed appropriately, and, most importantly, they work on a contingency basis. That means your motorcycle accident lawyer only gets paid if they win your injury case.

Did you know that a motorcycle is not considered a "motor vehicle" under Michigan No-Fault Law? The result is that bikers do not receive the same coverage and protection that standard motor vehicle policies provide. Michigan motorcycle accident lawyers are well-versed in the complicated No-Fault Law that impacts so many of the state’s motor vehicles on the road today.

That’s why we encourage you to try the Bernstein Biker Advantage® and find out how our award winning law firm of motorcycle accident attorneys, whether located near or far from you, can walk you through your case.

And don’t delay, you could end up receiving less compensation than you are entitled to under Michigan law.

WHY PEOPLE CHOOSE OUR TEAM OF MOTORCYCLE ACCIDENT LAWYERS

THE BERNSTEIN BIKER ADVANTAGE® MEANS TAKING YOUR CASE PERSONALLY

We care because our attorneys also ride. We know the joy and exhilaration that comes with a beautiful Michigan ride in the warm season. And we understand the unique challenges many motorcycle riders face in this state.

We are Michigan's most experienced personal injury law firm with over 600 years of combined legal experience. Our motorcycle accident lawyers take your cases personally because we know how devastating a motorbike accident can be to you and your family. So be sure to work with a personal injury law firm that knows what is required to win your case and get you the settlement you need.

Try the Bernstein Biker Advantage®. Contact us today to set up a free, no-obligation consultation.

OUR MOTORCYCLE INJURY ATTORNEYS WIN

At The Sam Bernstein Law Firm, our motorcycle accident attorneys have been winning for our clients for over 50 years and three generations. In one case, we won a motorcycle crash victim a $750,000 dollar settlement to help ensure their bills were paid and that they received the care and rehabilitation necessary.

Frequently Asked Questions About Motorcycle Accident Claims

HOW LONG DO I HAVE TO FILE A CLAIM AFTER A MOTORCYCLE ACCIDENT?

Michigan has strict statutes of limitations for filing motorcycle accident claims and lawsuits. If you fail to meet the prescribed deadlines, you may forfeit the chance to receive the benefits you are entitled to.

If another vehicle is involved, an injured motorcyclist has one year from the date of the accident to file a claim for Personal Injury Protection (PIP) benefits. This includes reimbursement for expenses such as medical bills, attendant care, mileage, lost wages and replacement services. Medical and related expenses are limited to the amount of PIP medical benefits selected by the policyholder. Lost wages and replacement services are covered for up to three years.

Moreover, victims have three years from the date of an accident to file a claim for non-economic damages such as pain and suffering. This timeline also applies to lawsuits filed to recoup excess economic losses such as medical expenses that exceed the driver’s Personal Injury Protection (PIP) medical coverage limit. These third-party benefits, which can be substantial, are typically paid by the insurer of the driver that caused the accident. In Michigan, victims are entitled to these damages only if they were less than 50% at fault for the accident.

In a fatal motorcycle accident the deceased’s survivors may be able to file a wrongful death lawsuit. In that case, the three-year deadline starts on the date of death.

In addition, minors have until one year after their 18th birthday to file a claim, regardless of when the accident occurred. There are other exceptions for military personnel, mentally incapacitated individuals and survivors of those killed in a car accident.

Nonetheless, there may be exceptions to these rules that apply in certain situations. That’s why you should always consult a knowledgeable personal injury attorney to discuss your individual case.

HOW MUCH DO MOTORCYCLE ACCIDENT LAWYERS CHARGE?

A reputable accident lawyer typically does not charge up-front fees or retainers to take your case. Personal injury attorneys, which includes car accident lawyers, work on a contingency basis. This means they don’t collect their fee (typically one-third of the verdict or settlement) until your case is resolved.

In addition, most accident lawyers charge for out-of-pocket expenses such as obtaining and copying medical records. However, in most cases, plaintiffs do not have to pay these costs until they receive their settlement.

HOW DO I KNOW IF I AM ENTITLED TO NO-FAULT BENEFITS AFTER A MOTORCYCLE ACCIDENT?

A motorcyclist is entitled to No-Fault benefits only if an operating motor vehicle (passenger car, van, SUV or truck) played a significant role in the accident. The law does not require actual physical contact between the motorcycle and the motor vehicle.

A motorcyclist is not eligible for No-Fault benefits if an accident did not involve another vehicle. Examples are a motorcyclist who hits a deer or a tree, or a biker who loses control and runs off the road.

HOW DOES THE NEW MICHIGAN NO-FAULT LAW AFFECT MY MOTORCYCLE ACCIDENT CASE?

Every vehicle owner in Michigan is required to carry No-Fault insurance. Typically, if a driver is injured in a motor vehicle accident, their Personal Injury Protection (PIP) benefits cover medical and related expenses according to the PIP medical coverage limits they have selected.

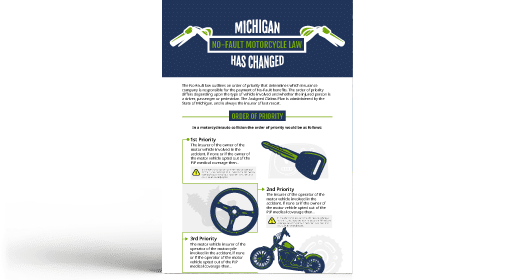

However, according to the Michigan Vehicle Code, motorcycles are not considered motor vehicles. Therefore, motorcyclists are not entitled to the same benefits as automobile drivers. An injured motorcyclist is entitled to No-Fault benefits ONLY when another vehicle was involved in the accident.

In that instance, the following order of priority is used to determine who is responsible for paying the No-Fault benefits of an injured motorcyclist:

1st - the No-Fault policy of the owner of the motor vehicle involved in the accident

2nd - the No-Fault policy of the driver of the motor vehicle operator involved in the accident

3rd - the No-Fault auto policy of the motorcycle operator (if one exists)

4th - the No-Fault auto policy of the motorcycle owner (if different from the motorcycle operator)

5th - Michigan Assigned Claims Plan (MACP), which caps allowable medical expenses at $250,000

(NOTE: If anyone in the order of priority has opted out of PIP allowable expense coverage, motorcyclists look to the next order of priority, until there is some level of PIP allowable expense coverage. )

The recent extensive Michigan No-Fault reforms have a huge impact on motorcycle accident claims. Prior to July 1, 2020, every Michigan No-Fault policy included unlimited lifetime medical benefits, including rehabilitation and home care. However, after July 1, 2020 policyholder can choose from a variety of Personal Injury Protection (PIP) medical benefit levels. Policy holders may keep their previous unlimited lifetime medical benefits, choose a lesser amount ($500,000, $250,000 or $50,000 for Medicaid recipients), or opt out of PIP medical coverage if they have Medicare or other qualified health coverage.

Other PIP benefits, which did not change under the new law, cover up to 85% of lost wages and $20/day for replacement services (such as housework and lawn care) for up to three years.

If the other driver does not have sufficient PIP medical benefits to cover the motorcyclist’s injuries, the motorcyclist’s only recourse is to sue the driver for the excess expenses.

However, because these cases involve complex legal issues, it’s important to contact our team of motorcycle accident lawyers immediately if your injuries affect your ability to live your normal life.

To learn more, visit the following link to view and download our Michigan No-Fault Law resources.

WHAT IS MICHIGAN’S HELMET LAW?

Despite the fact that helmets have been proven to save lives, some motorcyclists prefer to ride without them. Since 2012, when the state’s mandatory helmet law was repealed, Michigan riders can choose whether to wear a helmet, as long as certain conditions are met. In order to ride without a helmet, a motorcycle operator must:

- Be at least 21 years old

- Have at least $20,000 in Personal Injury Protection (PIP) medical benefits in addition to the liability insurance required for all motorcyclists

- Have held a motorcycle endorsement for at least two years, or have passed an approved motorcycle safety course

Motorcycle passengers who wish to ride without a helmet must:

- Be at least 21 years old

- Have at least $20,000 in Personal Injury Protection (PIP) medical benefits in addition to the insurance all motorcycle operators must carry

All motorcycle operators and passengers under 21 years old must wear a helmet. In addition, individuals younger than 19 must wear a helmet if operating a moped on a public roadway.

All helmets worn by Michigan motorcyclists of any age must comply with U.S. Department of Transportation (DOT) standards.

Although helmets are optional for most riders, wearing one can reduce the risk of a severe head injury in the event of an accident.

And, if you or a loved one is injured in a motorcycle accident, contact us immediately for a free consultation - before you sign any insurance papers. Get the Bernstein Biker Advantage® today.

IF MY MOTORCYCLE WAS UNINSURED, CAN I STILL SUE THE DRIVER WHO HIT ME?

Yes. Because motorcycles are not considered motor vehicles under Michigan no-fault law, injured motorcyclists do not have the same protections as automobile drivers. However, an injured motorcyclist who does not have insurance may still file a lawsuit against the motor vehicle driver who caused the accident, but they are not eligible for PIP benefits.

However, recovering reimbursement for medical bills, in addition to non-economic damages such as pain and suffering, is a complicated legal process. And, if a motorcycle passenger is injured, the legal issues are compounded further.

This is why it’s important to contact us today if you or a loved one was injured in a motorcycle crash. Our experienced attorneys understand the intricacies of motorcycle accident law. Let us help you win the compensation you deserve.

WHAT IF MY MOTORCYCLE CRASHED BECAUSE THE ROAD WAS POORLY MAINTAINED?

Michigan roads are notorious for potholes, especially after a long winter. These craters, some of which are quite large, can cause accidents and vehicle damage. Motorcycles, which lack the stability of passenger cars, are especially susceptible to potholes and other road hazards caused by poor maintenance or inadequate repairs.

If there was no other vehicle involved, a motorcyclist may be able to make a claim against the state, county, or local government agency responsible for the roadway. However, these cases involve complicated legal issues, and many municipalities are protected by governmental immunity laws. Also, the time limit for filing these claims is much shorter than the time frames for pursuing other legal actions.

That’s why you should contact us immediately if you were injured in an accident caused by a poorly maintained road.

Client reviews

"THEY KEPT ME UPDATED."

- Veronica, Actual Client

"I WILL BE FOREVER GRATEFUL."

- Tim, Actual Client

"I FELT LIKE I WAS A PART OF THE FAMILY"

- Terrence, Actual Client

"VERY PROFESSIONAL & KNOWLEDGEABLE"

- Sherry, Actual Client

"PASSIONATE, COMPETENT, COMMITTED"

- Actual Client

"THEY STAND BY THEIR WORD."

- Actual Client

"KIND & COMPASSIONATE"

- Nancy, Actual Client

"YOU CAN TRUST THEM 100%."

- Michael, Actual Client

"HONEST, CARING, SUPPORTIVE."

- Janice, Actual Client

"THEY TOOK PERSONAL INTEREST IN ME."

- Janice, Actual Client

"I KNEW I WAS IN GOOD HANDS"

- Jerry, Actual Client

"NUMBER ONE PERSON I'D RECOMMEND."

- Actual Client

"SAM'S GOT YOU COVERED."

- Chris, Actual Client

RECOMMENDED READING

HELMET LAW REPEAL CAUSES RISE IN MOTORCYCLE ACCIDE...

It has been over a decade since the Michigan legislature rep Read more…

November 21, 2023

BAD MOTORCYCLE TIRES CAN BE DEADLY: WHAT BIKERS SH...

Motorcycle accidents are caused by a variety of factors that Read more…

July 25, 2023

CAN GRASS CLIPPINGS CAUSE DEADLY MOTORCYCLE ACCIDE...

During late spring and summer, an abundance of grass clippin Read more…

July 24, 2023

HOW TO AVOID SUMMER MOTORCYCLING ACCIDENT HAZARDS...

The longer days, warmer temperatures and sunny skies of summ Read more…

July 24, 2023

CAN AN INJURED PASSENGER IN A MOTORCYCLE ACCIDENT ...

May is the start of peak riding season in Michigan, where bi Read more…

June 13, 2023

LATEST STATISTICS SHOW RISE IN FATAL MOTORCYCLE AC...

The latest motorcycle accident statistics show a rise in fat Read more…

September 12, 2022

Does Medicare Cover Motorcycle Accidents in Michig...

You don’t have to be young to experience the exhilaration Read more…

September 21, 2021

What Today’s Bikers Can Learn from the Hurt Repo...

What is the Hurt Report? Although it was published in 1981, Read more…

June 7, 2021

6 Common Injuries Caused by Motorcycle Accidents i...

For a motorcyclist, nothing compares with the exhilaration o Read more…

May 28, 2021

Everything Michigan Bikers Need to Know About Moto...

To commemorate Motorcycle Safety Awareness Month, the Nation Read more…

May 20, 2021

Motorcycle Accidents without Insurance: What Every...

As confusing as Michigan’s No-Fault system is to automobil Read more…

May 18, 2021

Best Motorcycle Rides in Michigan: 2021 Top Roads ...

With warmer weather and longer days on the way, it’s the p Read more…

May 18, 2021

A Crash Prevention Guide for Motorcyclists and Aut...

Do you know the majority of motorcycle accidents involve at Read more…

May 14, 2021

The Motorcycle Accident Statistics Every Michigan ...

While motorcyclists derive many benefits from riding, they a Read more…

May 5, 2021

Licensing Rules and Other Michigan Laws for Electr...

Spring is the perfect time for electric motorbikes, mopeds o Read more…

May 3, 2021

How to Check Your Motorcycle for Damage After a Cr...

A motorcycle accident is a traumatic experience, for the rid Read more…

April 22, 2021

A Guide to the Michigan Laws for Motorcycle Passen...

Once you know the exhilaration of riding a motorcycle, it’ Read more…

September 30, 2020

WHAT EVERY BIKER NEEDS TO KNOW ABOUT MICHIGAN MOTO...

When the Michigan legislature repealed the mandatory motorcy Read more…

September 29, 2020

Hiring an Attorney for a Motorcycle Accident...

Are you thinking about hiring a Michigan motorcycle accident Read more…

September 21, 2020

What Every Biker Should Know: A Basic Guide to Mic...

If you are reading this, chances are you already know the ma Read more…